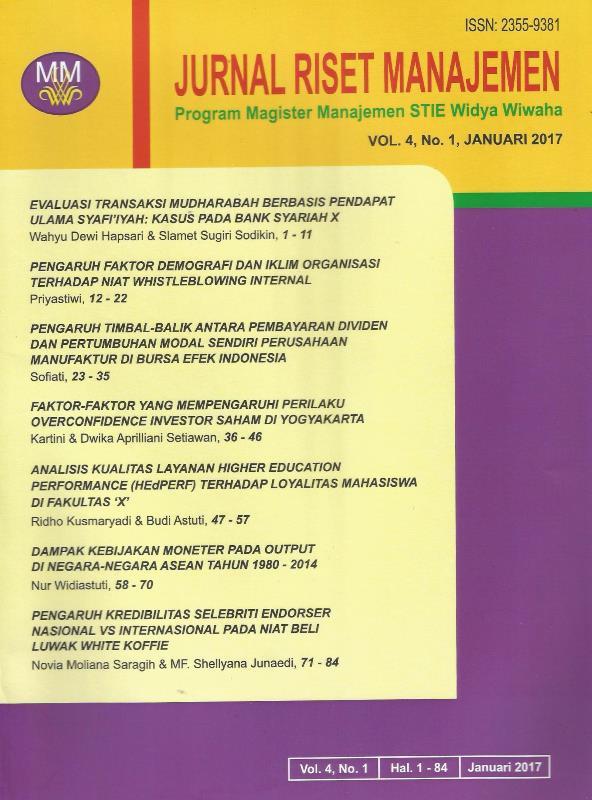

EVALUASI TRANSAKSI MUDHARABAH BERBASIS PENDAPAT ULAMA SYAFI'YAH: KASUS PADA BANK SYARIAH X

DOI:

https://doi.org/10.32477/jrm.v4i1.57Keywords:

Mudharaba Ttransactions, Shafi’iya’s School of ThoughtAbstract

Bank Sharia X, located in certain city in the province of central Java, is one of branches of Bank Muamalat Indonesia. As the name implies, Bank Sharia X operates its business based on Islamic rules (Al-Quran and Al-Hadist). In interpreting the Al-Qur’an and Al-Hadist, Islamic scholars have different opinions on requirements of some specific topics, such as those on mudharaba transaction. Among the great schools of thoughts are Syafiiya, Malikiya, Hanafiya, and Hanabila. We aim to identify whether or not Bank Sharia Xfully applies its mudharaba transaction based on Syafiiyas school of thought. We collect data by interviewing key persons of the bank and investigating important, corroborating documents out there. We analyze the data by comparing between the application of mudharaba transaction and the Shafees school of thought on the themudharaba transaction. Based on our analysis, we find that Bank Sharia X applies its mudharabatransaction based on the requirements of Shafees thought except on (a) ijab and qabul, and (b) time limitation.

References

Anshori, Abdul Ghofur (2006), Gadai Syariah di Indonesia-Konsep, Implementasi dan Institusionalisasi, Yogyakarta: Universitas Gadjah Mada Press.

Antonio, M. Syafi’i (2012), Bank Syariah Dari Teori Ke Praktik, Cetakan Kesembilan, Jakarta: Gema Insani.

Ghazali, Abdul Rahman (2012), Fiqih Muamalah, Jakarta: Kencana Prenada Media Group.

Ghony, M. Djunaidi dan Fauzan Al Manshur (2016), Metode Penelitian Kualitatif, Yogyakarta: Ar Ruzz.

Karim, Adiwarman. A. (2016), Bank Islam- Analisis Fiqih dan Keuangan, Jakarta: PT. Rajagrafindo Persada.

Kayed, N. Rasem (2012), The Entreprene uria l Role of Pro f it and Lo ss Sharing Modes of Finance-Theory and Practice, International Journal of Islamic and Middle Eastern Finance and Management, Vol 51, ss 3, pp 208- 228.

Khalid, Ulya (2014), “Evaluasi Transaksi Mu raba hah Berd asa rkan Fiq ih Muamalah dan PSAK 102 (Akuntansi Murabahah) Studi Kasus PT. Bank Pembiayaan Rakyat Syariah Harta Insan Karimah cabang Ciledug”, Skripsi Tidak Diterbitkan, Jurusan Akuntansi Fakultas Ekonomika dan Bisnis Universitas Gadjah Mada Yogyakarta.

Khosyi’ah, Siah (2014), Fiqih Muamalah Perbandingan, Bandung: CV. Pustaka Setia.

Mardani (2012), Fiqih Ekonomi Syariah- Fiqih Muamalah, Jakarta: Kencana Prenada Media Group.

Majelis Ulama Indonesia (2000), “Fatwa MUI No 15/DSN-MUI/IX/2000 tentang Distribusi Bagi Hasil Bank Syariah”.

NN (2005), “Mushaf Al Quran Terjemah”, Jakarta: Al Huda Kelompok Gema Insani.

Nurhayati, Sri dan Wasilah (2011), Akuntansi Syariah di Indonesia, Jakarta: Salemba Empat.

Rozdianda (2016), Fiqih Ekonomi Syariah- Prinsip dan Implementasi Pada Sektor Keuangan Syariah, Jakarta: PT. Grafindo Persada.

Sanusi, Anwa r (20 13), Met odo lo gi Penelitiaan Bisnis, Cetakan ke Tiga, Jakarta: Salemba Empat.

Saroja, Samiaji (2012), Penelitian Kualitatif- Dasar-dasar, Jakarta: Permata Puri Media.

Sekaran, U. dan Bougi, R. (2013), Research Methods for Business a Skill-Building Approach, Chichester: Wiley.

Sorina (2013), “Shariah Concept in Islamic Banking”, Bulletin of The Transilvania Universityof Brasov-Economic Science Series, Vol 6.2, pp. 139-146.

Syarifudin, Amir (2013), Garis-garis Besar Fiqih, Jakarta: Kencana Prenadamedia Group.

Tahsin Syafiq, Fati (2012), “Penerapan Nisbah Bagi Hasil Dalam Akad Pembiayaan Mudharabah di BMT Shohibul Umat Rembang”, Tesis Tidak Diterbitkan . Program Megister Kenotariatan Universitas Gadjah Mada Yogyakarta

Tim Pengembangan Perbankan Syariah Institut bankir Indonesia (2003), Konsep, Produk, dan Implementasi Operasional bank Syariah, Jakarta: Djambatan.

Undang-Undang No 10 Tahun 1998 tentang Perbankan.

Wiroso (2011), Produk Perbankan Syariah, Jakarta: LPFE Usakti.

Yulianto, Agung dan Badingatus Sholikah (2016),The Internal Factors of Indonesian Shariah Banking to Predict The Mudharabah Deposito, Review of Integrative Business and Economic Research: GMP Press and Printing, Vol 5.1, pp. 210-218.